Introduction

An important task is the timely management of Provider Tariff Plans. While business practices differ somewhat, usually, each Provider will deliver an initial spreadsheet file detailing their prices to the range of Destination Codes that they are providing. This initial spreadsheet will be followed by update notification spreadsheets. These will be received at regular agreed-upon intervals, identifying amendments to the previous prices.

The format and content of these notifications are not standardized and consequently differ from one provider to another. This information is vital, from a commercial and financial management point of view. It is therefore important that the rating information received from a Provider is uploaded regularly, in order that the System can correctly calculate Provider rating costs for calls. It is also important to analyze Tariff/Rating Plan updates received from partners, in order to ensure that any errors are noticed early and resolved before causing Billing disputes.

Doing all this by hand is a long and tedious process. It is possible to automate it with a human-in-between approach that requires confirming the final import step, to avoid potential misconfiguration problems.

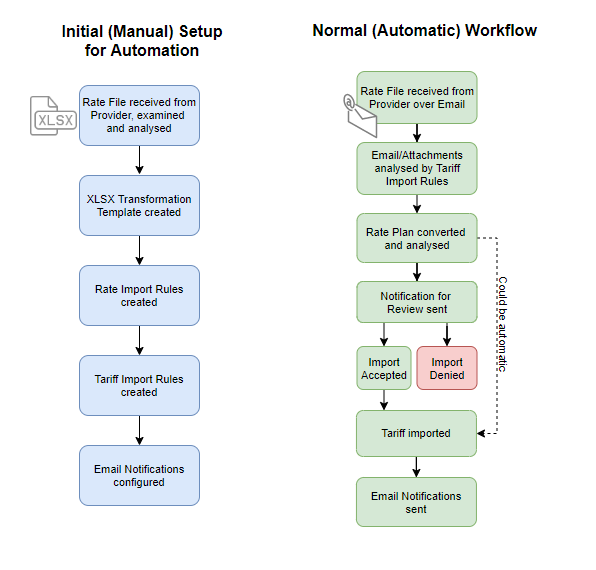

The Automatic Tariff Import workflow can be visualized using the following schema:

As can be seen, there are two components to this process:

- The configuration component, which is done once for each tariff file received from the provider

- The actual working component, where an automated process takes care of the tariff import, based on the settings configured in the first component

Initial (Manual) Setup for Automation

This sequence of steps is necessary to configure automatic import of the concrete tariff format received from any provider. Once configured, it can be used many times thereafter, until the provider decides to change the format.

Rate file received from Provider examined and analyzed

As every Provider sends different format files, their structure should be analyzed and necessary fields marked for Template creation.

XLSX Transformation Template created

The Provider Import Template is the primary object that requires configuring before the Provider Rating Import can occur. The Provider Import Template contains the settings that the System uses to convert information from the Spreadsheet into the System.

Rate Import Rules created

The Rate Import Rules feature enhances the analysis of the Providers‘ rates by identifying rates that do not meet a specific criterion (for example, a rate increase with fewer than seven days notice) and then either alerting the Administrator or rejecting the rate.

Tariff Import Rules created

Tariff Import Rules assign each received Email/Attachment to the correct Provider/Tariff with appropriate Rate Import Rules, Notifications, and Template to properly convert received Tariffs and upload rates to the System.

Email Notifications configured

Notifications will generate an email to the desired recipient when configured for various events, such as:

- Tariff is received

- The tariff is analyzed and waiting for confirmation before import

- The tariff is imported or rejected

- Others

Normal (Automatic) Workflow

Based on preconfigured settings in the first step, the Automatic Tariff Import could be carried out by using all the defined settings.

Rate file received from Provider via email

One mailbox, usually named by rates@companyname.com, is monitored by the system and all received emails are analyzed.

Email/Attachments analyzed by Tariff Import Rules

When an email with a tariff attachment comes in, it is checked for address, email subject, attachment name, and other parameters to properly map the received Tariff file with the following procedures.

Rate Plan converted and analyzed

Based on the Tariff Import Rules, the Tariff file is converted to a standardized format (a process called Normalization) and then analyzed. During analysis, the Rate Import Rules are applied and necessary actions are taken based on the Rules.

Notification for Review sent

If there are no major problems, the responsible person receives an email saying that the Tariff is converted with such and such notices or warnings, and waits for approval. It is possible to skip this step with 100% automation, but it is usually not recommended, due to possible errors that human intervention could help to avoid..

Import Denied

The responsible person can deny the tariff import, based on the information received. The analysis could identify errors that can’t be ignored or some other issues.

Import Accepted

If there are no major issues, the responsible person accepts the tariff import and the system is notified to continue the import.

Tariff Imported

The actual tariff import takes place, and old rates are replaced by the new ones. All of the preparation work culminates in this step.

Email Notifications sent

As a final step, an email is sent to the responsible person with confirmation about the import status to notify about the final step in the process.

Conclusion

As you can see from this short guide, automating tariff imports could seem like a complicated task, but it’s really worth it. A one-time setup, and tuning from time to time, saves considerable time and avoids human error.

When there are only a few Providers, doing all this manually seems like a simple task. But when a business starts to grow and Providers start to send rate updates one after another, automation is the only way to deal with it effectively.

- Photo by David Rangel on Unsplash